|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

No Closing Fee Refinance: Understanding the Main Benefits and Real-World ExamplesRefinancing your home can be an excellent way to reduce your mortgage payments or adjust your loan terms. One attractive option is a no closing fee refinance, which allows homeowners to refinance without paying hefty closing costs. In this article, we'll explore the benefits of this option, provide real-world examples, and answer common questions. What is a No Closing Fee Refinance?A no closing fee refinance is a type of mortgage refinance where the lender covers the closing costs. These costs can include appraisal fees, title fees, and other expenses typically associated with refinancing. This option can be beneficial for those looking to reduce upfront expenses. Benefits of No Closing Fee Refinance

Real-World ExampleConsider a homeowner in Minnesota who is looking to take advantage of current refinance rates in MN. By choosing a no closing fee refinance, they save money upfront, making the refinance process smoother and more affordable. Potential Drawbacks

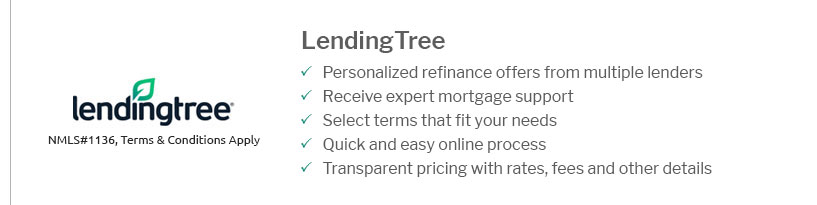

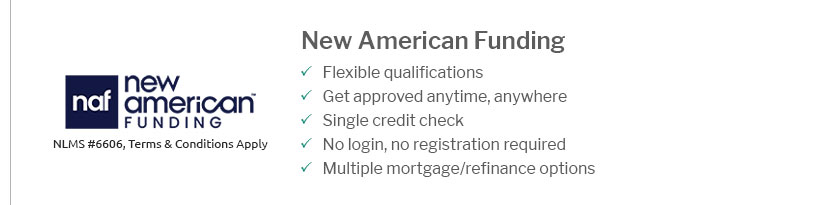

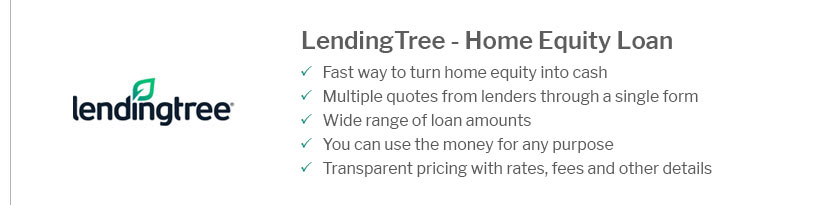

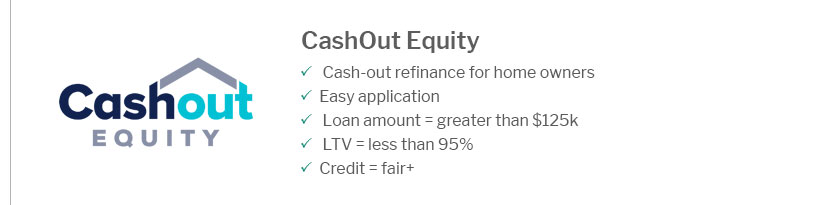

Comparison with Traditional RefinanceWhen comparing with traditional refinance options, it's essential to consider both the immediate savings and the long-term financial implications. A no closing fee refinance might lead to higher monthly payments due to increased interest rates. Finding the Right LenderWhen exploring refinancing options, it's crucial to work with best home loan lenders who can offer competitive rates and terms. Doing thorough research can help you find the best fit for your financial situation. Frequently Asked QuestionsWhat are the typical costs covered in a no closing fee refinance?Typically, costs such as appraisal fees, title insurance, and application fees are covered by the lender in a no closing fee refinance. How do lenders compensate for waiving the closing fees?Lenders may charge a slightly higher interest rate to make up for the costs they cover in a no closing fee refinance. Is a no closing fee refinance available for all types of loans?While it is commonly available for conventional loans, it may not be offered for all types of loans, such as FHA or VA loans. In conclusion, a no closing fee refinance can be a valuable option for homeowners looking to save on upfront costs. However, it's essential to consider the long-term implications and work with reputable lenders to ensure you get the best deal possible. https://www.rate.com/resources/no-closing-cost-refinance

A no-closing cost plan will only reduce your upfront expenses. Rather than settling these fees at the loan's conclusion, this option delays the payment. https://www.discover.com/home-loans/articles/refinance-mortgage-no-closing-costs/

A mortgage refinance with Discover Home Loans comes with no closing costs. That means no application fees, no origination fees, no appraisal fees, and no cash ... https://lbcmortgage.com/no-closing-cost-mortgage-loans-california/

We're proud to work with an extensive network of lenders who offer no closing cost mortgages in California.

|

|---|